-

December 29, 2021

Many people begin the new year with a resolution of some sort, such as getting in better shape, learning a new skill, or traveling more. However, there is one resolution that can help you find peace of mind.

-

December 20, 2021

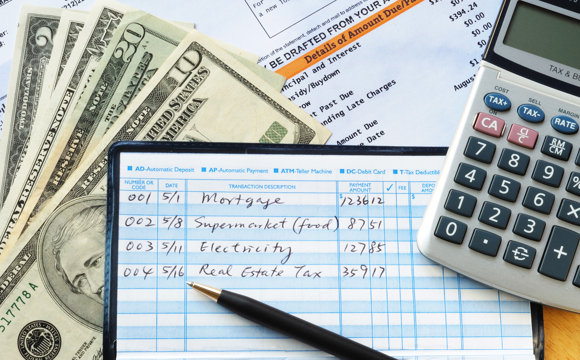

The New Year is a time for new beginnings. Are you ready to make money resolutions that stick? Eliminating debt, learning new spending habits, or building savings are choices that can change your life.

-

November 19, 2021

As the holidays approach, the need for charitable donations increase. Many people struggle to stay warm during the cold winter months, and there are families who have to go without Christmas.

-

November 4, 2021

Almost all of Utah businesses are required by state law to carry workers’ compensation insurance. Your workers’ compensation policy will help pay for medical expenses and lost wages of employees who sustain injuries while on the job.

-

November 4, 2021

Business leaders across Utah need and expect more out of their employee benefits packages, particularly in our current economic environment. Faced with one of the most competitive labor markets in history, taking care of employees is at the forefront of most organizations’ strategic discussions.

-

November 4, 2021

An earthquake is a sudden, rapid, shaking of the earth caused by the breaking and shifting of rock beneath the earth’s surface. Earthquakes strike suddenly, without warning, and they can occur at any time of the year, day or night.

-

October 26, 2021

Each month when a mortgage payment is made, a portion of the payment goes into a separate account called an escrow.

1 Comment

-

October 21, 2021

Another holiday season is upon us, and for the second year in a row, the impacts of COVID will likely impact the celebrations.

2 Comments

With Reward Yourself Checking, earn unlimited rewards points faster plus enjoy loan discounts, appraisal credits, and more valuable member perks.