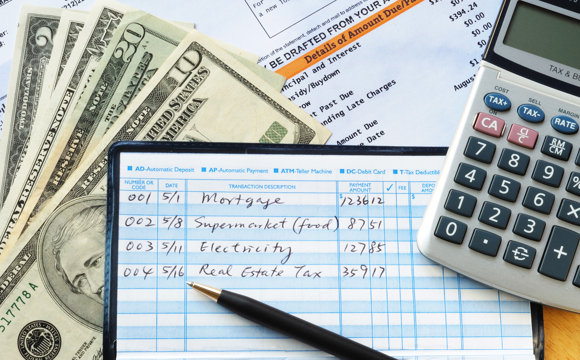

Conventional Mortgages

USU Credit Union offers a variety of affordable conventional mortgage options to best fit your needs.

We offer the options you need for a Conventional Mortgage loan that fits your needs.

Fixed-Rate Mortgage Loans

USU Credit Union offers conventional mortgage loans with fixed rates and terms. With a fixed rate mortgage, the interest rate does not change for the life of the loan.

Benefits of a Conventional Mortgage Loan:

- As low as 3% down

- Choose your term: 10, 15, 20, or 30 years

- Financing for second homes and investment properties

- No PMI (private mortgage insurance) when you put 20% down

USU Credit Union also offers Adjustable Rate Mortgage Loans.

-

Conventional Mortgage Rates*as low as

-

Some DescriptionSome IntroSome SubNote2Some TypeSome MonthsSome ValueSome APXSome SubNote1

Call or Click Now - Experienced Mortgage Experts Standing By

Send us a text

Contact Us

Learn more about opening a mortgage with Goldenwest Credit Union.

Buy or Refinance Now, and Get Your "Free-Fi" Later!

Introducing our exclusive Free-Fi promotion: Buy or refinance a home now, and refinance again for free within three years.

Talk to a mortgage expert today to get your application started!

Adjustable Rate Mortgage (ARM)

An Adjustable Rate Mortgage, or an "ARM", is a loan type that offers a lower initial interest rate than most fixed-rate loans. With most ARMs, the interest rate and monthly payment are fixed for an initial time period such as five years, seven years, or ten years. After the initial fixed period, the interest rate can change every year.

Jumbo Mortgage

Goldenwest currently offers Jumbo Mortgages for loan amounts exceeding $832,750. Speak with a mortgage specialist to help you decide if a Jumbo Mortgage is right for you.

Investment Property Mortgages

Finance your rental and investment properties at competitive rates and fees at Goldenwest. Goldenwest can help you secure financing for rental and investment properties with up to 80 percent loan-to-value at competitive rates, low fees and a variety of terms.