How bill pay works

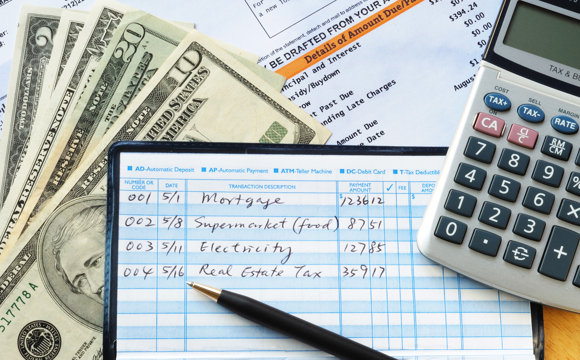

Skip the hassle of writing checks and buying stamps to pay your bills. Goldenwest’s bill pay service is fast and free...saving you time and money! With online bill pay, you can send payments to almost any person, company or organization in the U.S. And for your convenience, you can schedule your recurring payments for monthly expenses such as loan payments or utility bills.

Payments are sent one of two ways—electronically or by paper checks. The majority of payments are delivered electronically. All other payments are made by paper checks that are mailed via the U.S. Postal Service.

Online bill pay helps guard against identity theft from lost or stolen checkbooks, bills and statements. It also increases your privacy because only you can access your account information, account numbers and payment history. As a result, you maintain tighter control of your account with real time access to your payments activity.

Save time. It takes only minutes to pay your bills each month. You save time on trips to the post office and filing away paper receipts. In addition, smart features such as recurring payments allow you to set up a schedule to pay your bills automatically.

Save money. Online bill pay saves on postage, envelopes, late fees, and checks. If you pay just 10 bills per month, you can easily save over $75.00* per year.

Stay organized. Your payment history is stored online so you won't have to file and sort through paper receipts.

Gain peace of mind. You can schedule payments in advance so you won't have to worry about paying bills when you travel. Bill pay reminders are also available to notify you it's time to pay your bill.

Help the environment by saving paper. With online bill pay, there are no checks to write or envelopes to mail. That's good news for you and the environment.

*Savings are approximate and based upon the average annual cost of stamps, envelopes, and checks required for paying ten bills per month.