Business Lines of Credit

Credit lines provide cash availability during seasonal or short-term needs for USU Credit Union business members

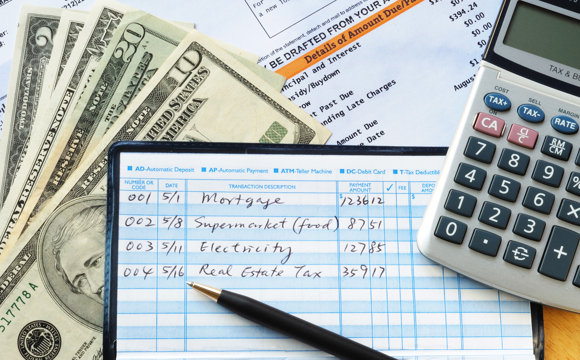

A business line of credit is similar to a credit card, used for business purposes. Credit lines provide cash availability during seasonal or short-term needs. Business lines of credit are easily accessible compared to loans, and they are not tied to a single expense. Business owners commonly use lines of credit to pay for situations such as payroll, inventory, seasonal expenses, overhead costs, and emergency funds. Businesses can apply for secured and unsecured lines of credit.

| UNSECURED | SECURED | |

| Higher rates compared to loans | Yes | Yes |

| Draw or maintenance fees | Yes | Yes |

| Can be used for many business purposes | Yes | Yes |

| Credit is tied to collateral | Yes | |

| Lower interest rates | Yes | |

| Higher credit limit | Yes | |

| Sign a personal guarantee and/or a UCC blanket lien | Yes |

Both forms of credit lines are good for business owners who need quick cash and flexible spending options. Most lines of credit have a draw fee, which is similar to an originator fee. For example, if you have a draw fee of 1% and you request $1,000, your lender will deduct $10 and you will receive $990. If you do not have a draw fee, a maintenance fee is probably charged. That is a flat fee charged on a periodic basis such as $10 per month.

A business credit card is an alternative to a business line of credit.

Commercial Lending Consultation

We are proud to help local businesses with their business needs. We strive to make the process as simple and fast as possible while providing great rates. We will help you determine your optimum financing needs and options.

To help expedite the process, please prepare the following documents:

- Current business profit and loss statement and a balance sheet.

- Last two years tax returns, business and personal, on any individual with 20% or more ownership.

- Personal financial statement on any individual with 20% or more ownership.

- Two years projections on any business less than two years old.

- Debt schedule listing all business and personal debts including balances and payments.

- Articles of incorporation and corporate bylaws for corporations.

- Articles of organization and operating agreement for LLCs.

Monday - Friday from 8 a.m. to 8 p.m.

Saturday from 9 a.m. to 4 p.m.

Closed Sundays.